The Airbnb Market in Ghana, Nigeria and Liberia. Which is best?

Airbnb’s presence in the West African market has significantly enhanced the profitability of the rental space, opening up new avenues for investors eager to cater to experience-driven travellers.

Did you know that Airbnb has over 8 million active listings worldwide? That’s right—as of June 2024, people just like you are opening their doors to travellers, sharing unique spaces in every corner of the world. With more than 5 million hosts as of December 2023, the Airbnb community is growing stronger every day. These hosts span over 100,000 cities and more than 220 countries and regions globally, making Airbnb truly a worldwide platform.

Together, Airbnb hosts have earned more than $250 billion as of the end of 2023. And for those in the U.S., the average annual earnings for a host is about $14,000.

South Africa leads the way in Africa’s Airbnb market, contributing about $1.2 billion in revenue in 2022, thanks to its robust tourism infrastructure and diverse travel offerings. While Airbnb’s revenue for the African continent isn’t specified, it falls under the EMEA (Europe, Middle East, and Africa) region, which collectively accounted for around 35% of Airbnb’s total revenue in 2023.

This growth has been especially driven by established European markets, but West African countries, such as Ghana, Nigeria, and Liberia, are rapidly emerging as hotspots for travellers seeking authentic, culturally immersive stays.

The West African market is quickly establishing itself as a dynamic, fast-growing segment for Airbnb, with Ghana, Nigeria, and Liberia leading the charge. If you’re considering an investment in a one-bedroom or studio apartment in these countries, the 2023 Airbnb data offers essential insights for maximising returns. According to one of Airbnb’s Market Managers for the Middle East and Africa (MEA) region, these statistics highlight key trends that are shaping this market’s potential and profitability.

READ ALSO: 5 questions you should ask your Ghanaian luxury real estate developer

As demand grows for unique, experiential stays, West Africa’s appeal is on the rise, capturing the interest of travellers seeking authentic connections with local culture. Investing in this sector now could be a strategic move, as this region continues to expand in popularity among Airbnb users worldwide.

Interest

Ghana has the highest interest from travellers as compared to the previous year. This means that Ghana seems to be doing something right when it comes to marketing. Ghana currently captures the highest interest from travellers in the West African Airbnb market, signalling effective marketing and positioning within the region.

This heightened interest indicates that Ghana is resonating with travellers by emphasising its unique cultural offerings and vibrant experiences. For investors, this makes Ghana particularly attractive, as the demand for short-term rentals is likely to continue growing, driven by the country’s strong tourism appeal and strategic outreach.

Bookings

Ghana leads the way again with the highest number of Airbnb bookings in the West African market, recording a remarkable 41% increase in 2023 compared to 2022. This growth underscores Ghana’s strong appeal among travellers and suggests an increasing reliance on Airbnb for accommodations.

In contrast, Nigeria experienced only single-digit growth, indicating that Airbnb remains a less common choice among visitors to Nigeria. Liberia, however, is showing promising growth in bookings, highlighting its potential as an emerging market within the region.

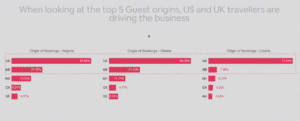

Top Countries

Ghana and Nigeria exhibit similar patterns in their Airbnb booking demographics, with travellers from the United States and the United Kingdom occupying the top two spots, respectively. Both countries see their own citizens in third place, followed by visitors from Canada and Germany in fourth and fifth. This indicates a strong interest from international travellers, particularly from English-speaking countries, which enhances the attractiveness of these markets for potential investors.

In contrast, Liberia presents a different dynamic. Interestingly, Ghanaians rank as the third-largest group of Airbnb bookers in Liberia, surpassing the number of local Liberians who book accommodations. This suggests that Ghanaians are keen to explore neighbouring Liberia, potentially driven by cultural and familial ties. For Liberia, travellers from Canada and Australia fill the fourth and fifth spots for Airbnb bookings, further indicating the international interest in this emerging market.

Average Length of Stay (LOS)

Liberia leads the West African region with the highest average length of stay (LOS) for Airbnb bookings, with guests averaging around 8 days. Ghana follows closely behind with an average of 7 days, while Nigeria has an average of 6 days.

This trend presents a significant opportunity for hosts in all three markets, as weekly stays tend to be among the most profitable for Airbnb hosts. Longer stays can enhance revenue stability and reduce the turnover costs associated with frequent guest changes.

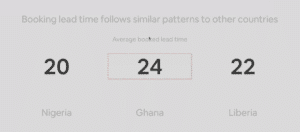

Booking Lead Time

Ghana once again stands out with the highest booking lead time, indicating that travellers are often booking their stays and checking in within 24 days. This trend is a positive sign of a consistent influx of visitors to the country, reflecting the growing interest and confidence in Ghana as a travel destination.

A shorter booking lead time is typically associated with a vibrant travel market, as it suggests that more potential guests are not only interested in visiting but are also actively taking steps to secure their accommodations. This correlation between interest and booking behaviour can be advantageous for hosts, as it may indicate that the demand for short-term rentals is likely to remain strong.

Average Daily Rates

Nigeria boasts the lowest average daily rates (ADR) among the West African countries, closely followed by Ghana, which captures a significant share of interest and bookings. Interestingly, Liberia has the highest daily rates, which may seem surprising given that the Ghanaian and Nigerian markets are larger and generally attract more visitors.

These pricing dynamics are noteworthy, particularly because Airbnb competes primarily with mid-range hotels that offer comparable price points across all three markets. This competition may drive hosts to differentiate their offerings, focusing on unique experiences and superior service to attract guests willing to pay a premium for distinctive stays.

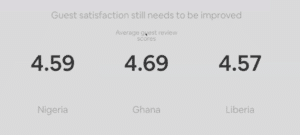

Average Guest Reviews

Globally, the average guest review rating on Airbnb stands at 4.8, indicating that there is still room for improvement across all markets, including those in West Africa. This presents an opportunity for hosts to enhance their offerings and improve guest experiences.

Its my hunch that the potential contributing factors to lower reviews include power outages and issues with appliances like air conditioners and washing machines. In regions where infrastructure can be unpredictable, these challenges can significantly impact a guest’s stay. Addressing these concerns—by ensuring reliable electricity supply, maintaining appliances, and providing backup solutions—could lead to higher satisfaction ratings.

For hosts looking to boost their reviews, focusing on customer service, prompt communication, and proactive maintenance can make a significant difference. Higher ratings mean more bookings.

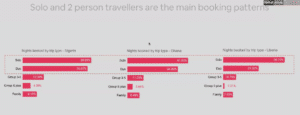

Booking Patterns

The majority of Airbnb bookings are indeed for apartments, reflecting the preference of travellers for home-like accommodations during their stays. While we may not have specific data on the types of apartments booked, we can draw reasonable conclusions based on the current trends in apartment construction in Ghana.

Given the growing demand for short-term stays, it is likely that most guests are opting for studios, one-bedroom, two-bedroom, and three-bedroom apartments for their week-long visits. These types of apartments typically offer the flexibility and amenities that travellers seek, such as kitchen facilities and spacious living areas, which are ideal for both solo travellers and groups or families looking for comfortable, affordable options.

This trend suggests a strong market potential for investors focusing on developing or listing these types of apartments on Airbnb. Understanding the preferences of travellers for short stays can help inform decisions about property features, design, and amenities, ensuring that offerings align with guest expectations and enhance the overall booking experience.

Booking information

Most Airbnb bookings are made by solo travelers, followed closely by couples, indicating a clear preference for accommodations that cater to individuals and duos. If you are considering owning an Airbnb unit, it’s essential to design your space to effectively accommodate these two primary groups.

For solo travellers and couples, features such as cosy, functional layouts, comfortable furnishings, and essential amenities (like kitchen access and Wi-Fi) are critical. Spaces should promote relaxation and convenience, allowing guests to feel at home during their stay.

The next tier of guests consists of small groups of 3 to 5 people, followed by families and larger groups of more than 5. While these groups may not represent the majority of bookings, they still present a valuable market segment. For this reason, it’s wise to consider flexible sleeping arrangements, communal spaces for socializing, and family-friendly amenities when designing your Airbnb.

Best Airbnb investment in West Africa

Given the compelling data and analysis, Ghana emerges as the premier choice for Airbnb investment in West Africa. It offers a unique blend of high guest interest, strong booking rates, competitive average daily rates, and a stable environment conducive to travellers.

These factors create a favourable landscape for potential investors looking to capitalize on the growing demand for short-term rentals. With its welcoming atmosphere and attractive offerings, Ghana stands out as the most promising option for those seeking to invest in the thriving Airbnb market in the region.

- High Interest from Western Nations: Ghana has attracted significant interest from travellers, particularly from the United States and the United Kingdom, which enhances its appeal as a destination.

- Robust Booking Growth: The notable increase in bookings and the highest booking lead time indicate a strong and consistent flow of visitors, making it a prime market for short-term rentals.

- Stable Economy and Real Estate Laws: Ghana’s stable and peaceful economy, along with favourable real estate laws, provides a secure environment for investment. This stability fosters confidence among both hosts and guests.

- Competitive Average Daily Rates: With competitive average daily rates, Airbnb hosts in Ghana can expect solid returns on their investments, especially as the demand for unique and experiential stays continues to rise.

- Suitability for Target Markets: The data suggests that the majority of travellers prefer smaller accommodations, such as studios and one-bedroom apartments, which aligns with current construction trends in Ghana. This opens up opportunities for hosts to cater effectively to solo and duo travellers.

The next question for potential investors is determining the best locations in Ghana for Airbnb investments. While many users are exploring non-central areas, the safest strategy is to invest in a studio, one-bedroom, or two-bedroom apartment in prime locations. These areas typically offer higher visibility and accessibility, attracting more guests seeking convenience.

Additionally, considering locations slightly outside the bustling city centre can be beneficial. Areas with stunning mountain views, riverfronts, or beachfronts are particularly appealing to travellers looking for scenic and tranquil getaways. These picturesque settings often enhance the overall guest experience, making them ideal for short-term rentals.

I also maintain an updated list of some of the best real estate investment options in Ghana. Feel free to share this resource with friends, and don’t hesitate to reach out if you’re interested in making any real estate transactions in Ghana. Together, we can navigate the opportunities within this thriving market!